How Tesla's Model 3 Price Hike Drove the EV Market into a Frenzy

In March, the electric vehicle (EV) market witnessed an unforeseen twist, primarily driven by Tesla's pricing strategy for its Model 3. After a period of price cuts that contributed to a significant drop in overall EV prices, March saw a reversal of this trend. The consequences of Tesla's pricing adjustments offer a window into the intricate dance of consumer demand, company strategy, and the broader EV market's health.

According to data from Kelley Blue Book's March Average Transaction Price report, the average price Americans paid for an EV in March was $54,021, marking an increase from February's revised figure of $53,707. The year-over-year figures, however, tell a more complex story. While EV prices in March were lower by 9.7% compared to the previous year, this reduction was not as substantial as February's 10.5% year-over-year drop.

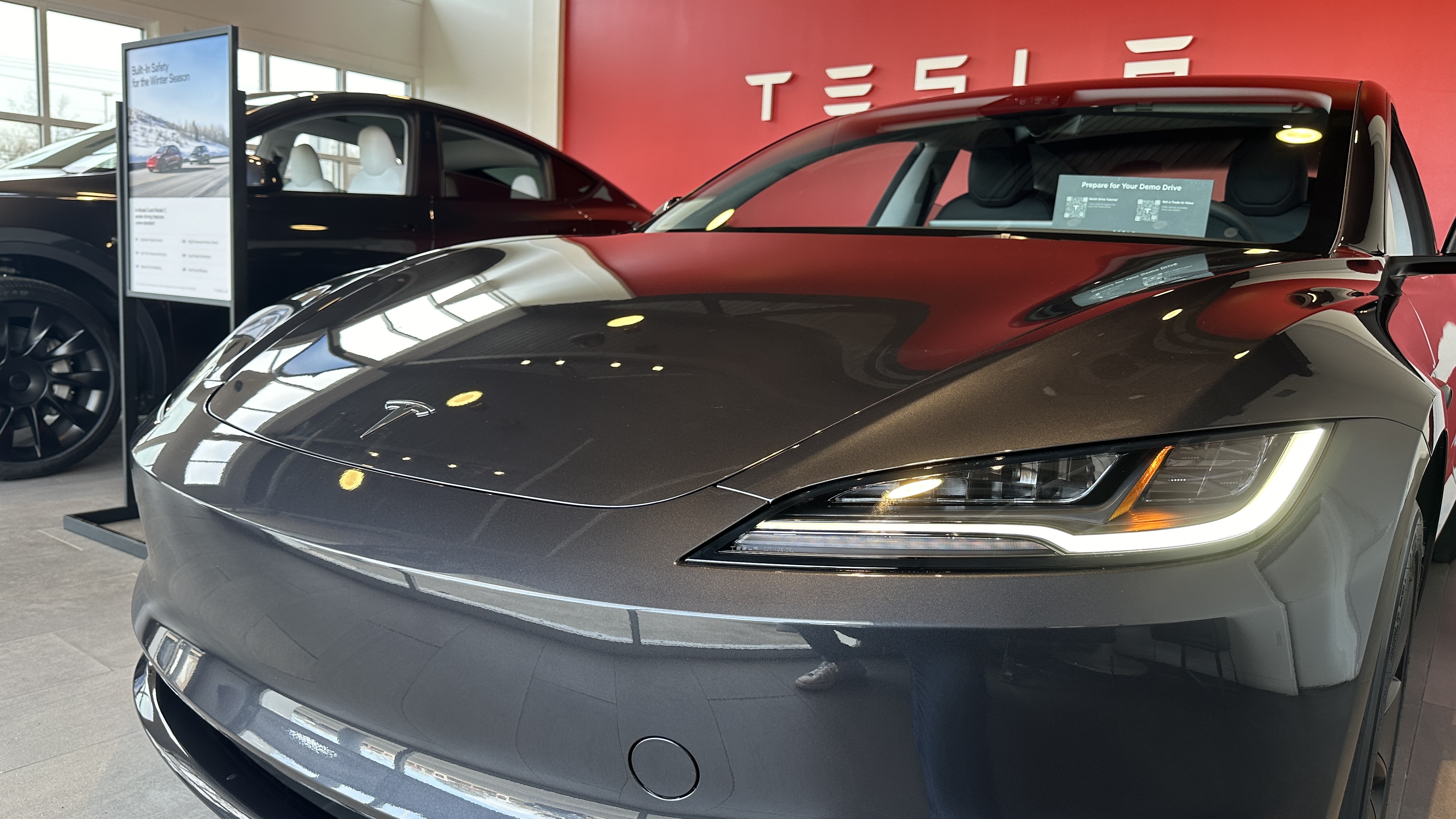

The spotlight falls firmly on the Tesla Model 3, whose transaction prices last month stood at $46,169. This figure represents a decrease of 5.6% from the year before, yet a significant month-over-month increase of 6.7%. Such fluctuations are noteworthy for several reasons, not least of which is the impact on consumer purchasing decisions and the subsequent reactions from other EV manufacturers.

Incentives offered by Tesla for the Model 3 were substantial, amounting to 8.2% of the average transaction prices or $3,778. Despite this, Tesla's overall incentives in March were outpaced by other players in the EV space. Polestar and Lucid, for example, offered incentives of 14.4% and 13.6% of their average transaction prices, respectively.

The role of incentives and discounts across the EV landscape continues to be a pivotal factor in driving down prices. However, as Stephanie Valdez Streaty, director of Industry Insights at Kelley Blue Book’s parent company Cox Automotive, points out, the interplay between lower prices and EV sales volume is complex. Despite a general decrease in the average transaction price for new EVs by 9.0% in Q1 [2024] compared to the same period in 2023, this price reduction has not translated into a significant uptick in sales volumes.

This nuanced perspective sheds light on the multifaceted nature of the EV market. Tesla's pricing strategies, particularly those concerning the Model 3, exert a considerable influence. Yet, the anticipated surge in sales volume in response to lower prices has not materialized as expected, suggesting that other factors are at play in consumers' decision-making processes.

The tension between price adjustments, incentives, and consumer response encapsulates the ongoing evolution of the EV market. It highlights the challenges and opportunities facing EV manufacturers as they navigate the complex web of market dynamics, regulatory environments, and consumer expectations. As the industry continues to mature, the strategies employed by leading players like Tesla will undoubtedly continue to shape the landscape and influence the broader push towards electrification.

For those considering making their homes more resilient and limiting power outages, the transition to solar energy, complemented by a battery storage system, presents a viable solution. Platforms like EnergySage simplify this journey by connecting potential buyers with trusted solar installers, ensuring competitive pricing and high-quality solutions. Exploring solar options not only contributes to sustainable living practices but also aligns with the broader trends influencing the automotive and energy sectors.